While most sellers are concentrated on selling and expansion, majority of them overlook the sophistication of tax handling. The truth is tax compliance is one of the most significant factors involved in operating an Ecommerce business. If you are in the initial stages of developing your store or operating a big, established Shopify storefront, being aware of tax responsibilities can help prevent you from penalties, audits, and financial stress.

ReportGuru breaks down intricate tax information with easy, automated, and actionable tax reports crafted specifically for Shopify sellers. From Canadian Tax Breakdown Report to USA Tax Summary (Shopify) Report, these reports present you with a complete picture of your tax obligations and payments in the markets in one dashboard. In this guide, we will break down the different types of tax reports available on ReportGuru, how they work, and why they are indispensable for your Shopify store.

Why Tax Reporting Matters for Every Shopify Store?

Each sale on your Shopify website is potentially liable for some type of tax, i.e., sales tax, VAT, or GST, depending on the location of your customers. For each merchant operating a Shopify website, this translates into having to work with multiple tax authorities, different rates, and constantly changing regulations.

Here’s why organized tax reporting is important:

- Accuracy and Conformity: Tax authorities expect accurate reporting. A small mistake can lead to audit or penalties.

- Transparency: Accountants, investors, and stakeholders want transparency in tax payments and obligations.

- Time Savings: Automated reports save you from the hours of manual reconciliation and calculations.

- Growth and Complexity: As your Shopify store grows into new markets, so does your tax complexity. Thus, these advanced reports keep you ahead.

By using dedicated tax reports, you can concentrate on expanding your Shopify online store instead of being overwhelmed with paperwork.

Types of Tax Reports Every Shopify Store Needs

ReportGuru offers a set of specialized tax reports tailored for Shopify merchants. Each report is designed to address specific regional, product-level, or summary needs, giving your Ecommerce storefront the clarity required to stay compliant and stress-free. A detailed overview of every report is as follows:

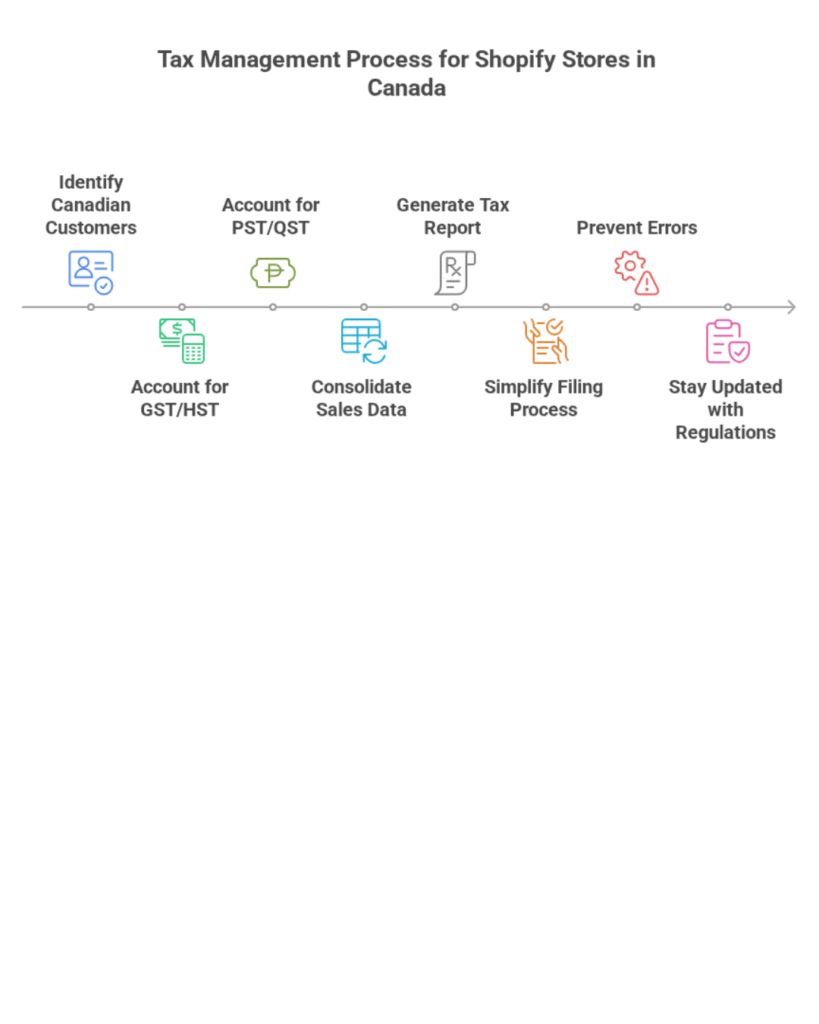

1. Canadian Tax Breakdown: In case your Shopify store has customers in Canada, you are required to account for federal GST/HST and provincial PST/QST rates. The Canadian Tax Breakdown report on ReportGuru consolidates all your sales by province in a straightforward manner, indicating how much tax was collected per jurisdiction.

This is especially useful if your Shopify storefront is spread out across several provinces. Rather than wading through endless spreadsheet rows, you have a neat breakdown of tax collected and owing. It simplifies the filing process, prevents errors, and keeps you up to date with Canada Revenue Agency regulations. Even in peak periods, you won’t need to frantically search for scattered tax information.

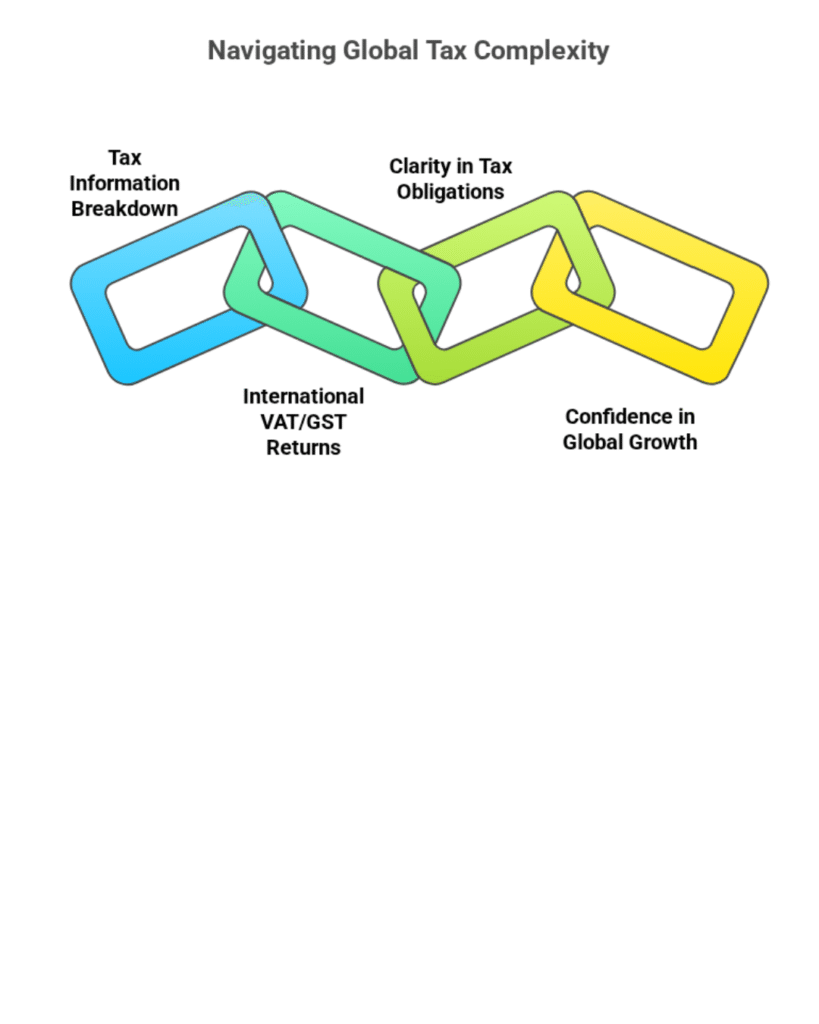

2. Country-Specific Tax Report: You already understand how complicated it can get to deal with the tax rules of different countries when you are a global seller. The Country-Specific Tax Report makes this easier. It breaks down tax information by country where your Shopify store has customers and gives you a clear overview of tax collected by region.

This report is invaluable when preparing international VAT or GST returns. Whether your Shopify store brings in customers from Europe, Asia, or Australia, you will have complete clarity on what you need to do in each country. This clarity gives you the confidence to grow your Shopify online store worldwide.

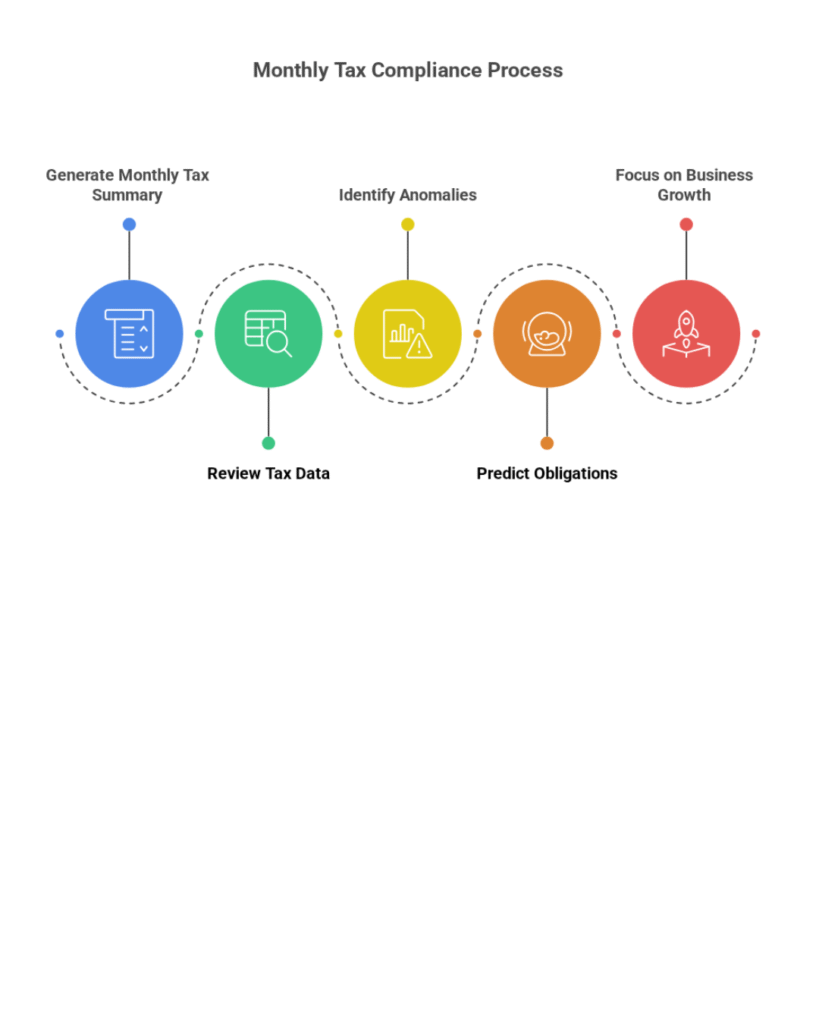

3. Monthly Tax Summary: Staying on top of monthly compliance is crucial for planning and cash flow. The Monthly Tax Summary report indicates the total taxes collected and remitted by your Shopify shop for a specific month.

It is particularly valuable for merchants that need to make quarterly or monthly returns. It provides you with an overview, allowing you to monitor trends, identify anomalies, and predict upcoming obligations. With this report, you can leave behind the mundane manual reconciliations on your Shopify site and concentrate on the most important thing, i.e., growing your business.

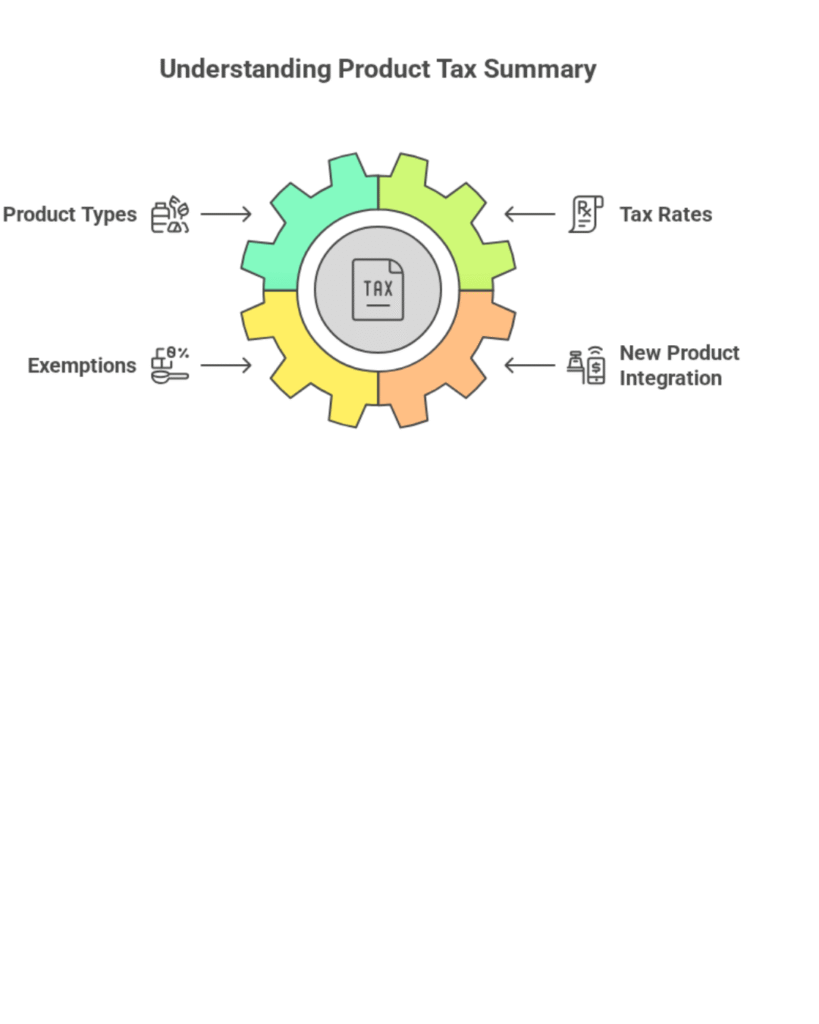

4. Product Tax Summary: Various products tend to come under varying tax rates or exemptions. The Product Tax Summary categorizes the revenues of your Shopify store based on product type and determines the tax amount collected on each.

This makes it simple to know which products fall under special rates, zero-rated taxes, or exemptions. It also comes in handy when you introduce new lines of products as you construct your store, knowing they are taxed properly from the very beginning. For a trader with a big Shopify store, this report saves time and guarantees consistent tax treatment for your catalogue.

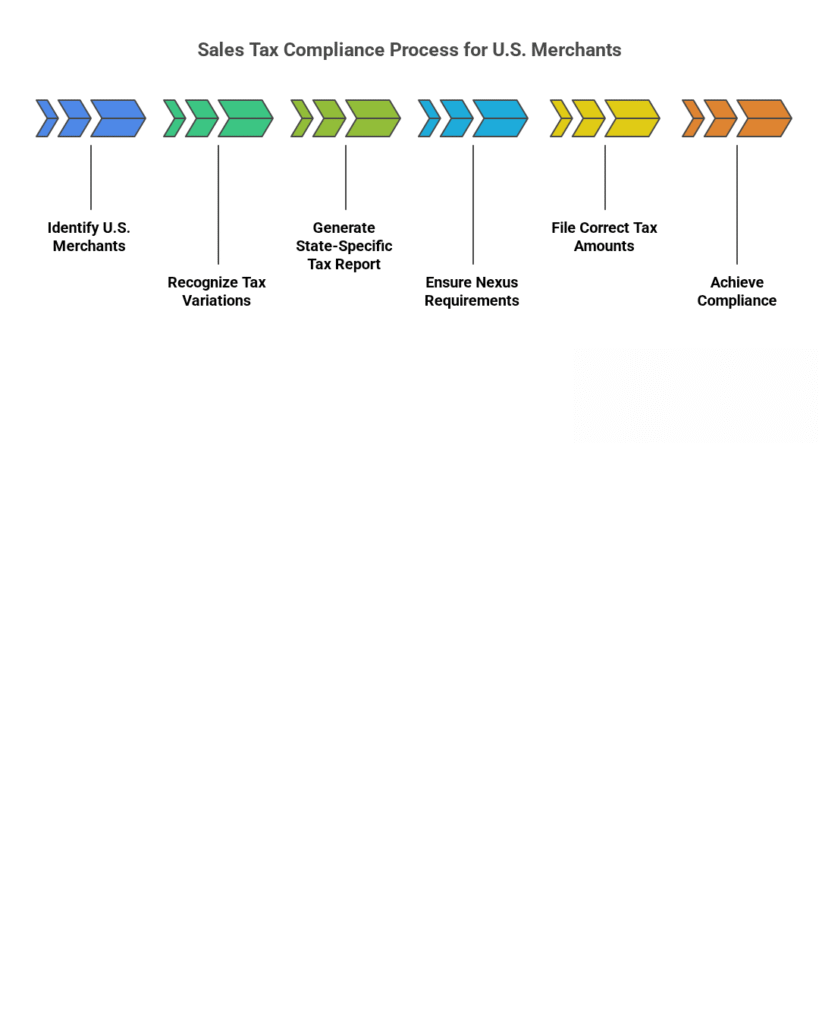

5. State-Specific Tax Report: For U.S. based merchants, sales tax varies by state and sometimes even by city or county. The State-Specific Tax Report gives your Shopify store a detailed breakdown of all taxes collected by state.

If your Shopify site has customers across multiple U.S. states, this report ensures you are meeting nexus requirements and filing the correct amounts with each state tax authority. Rather than working with broken spreadsheets or blanket apps, you have all the information in a single location, saving thousands of hours and ensuring compliance.

6. Tax Report (General): The Tax Report is an overview of your tax requirements across every market your store sells in. It brings together sales, tax rates, and amounts collected to provide a comprehensive view.

This report is essential for year-end tax returns, financial audits, or reporting to investors. It demonstrates your Shopify store is compliant, transparent, and poised for expansion.

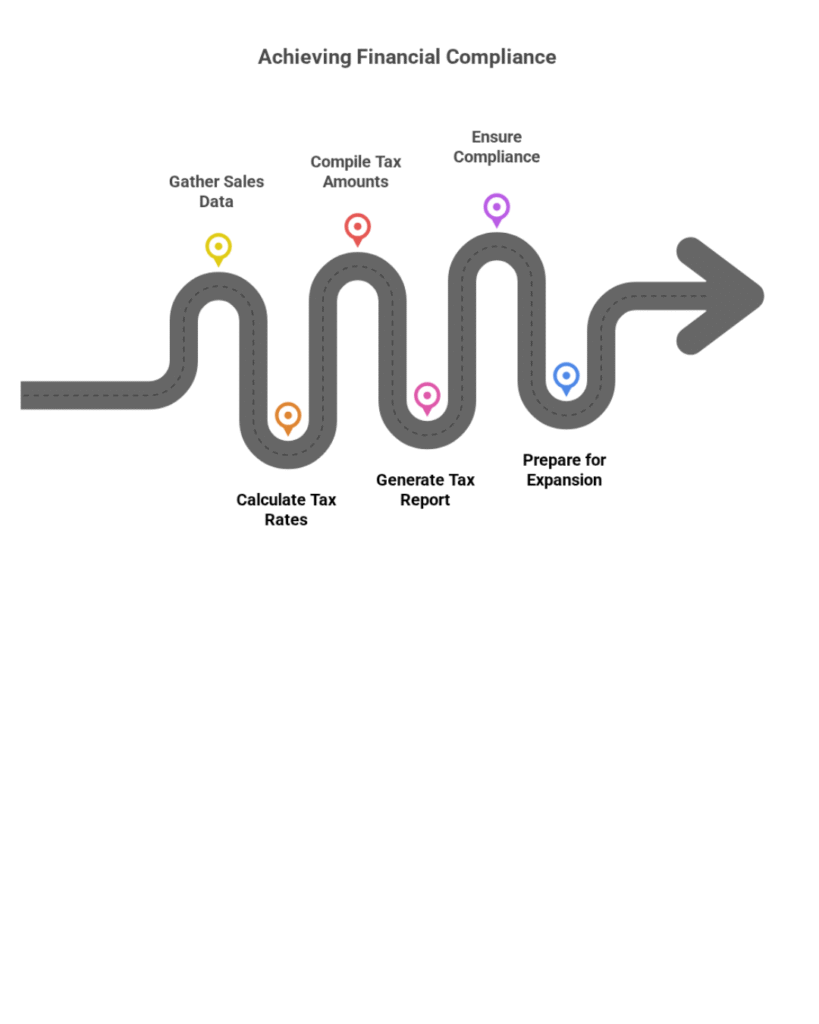

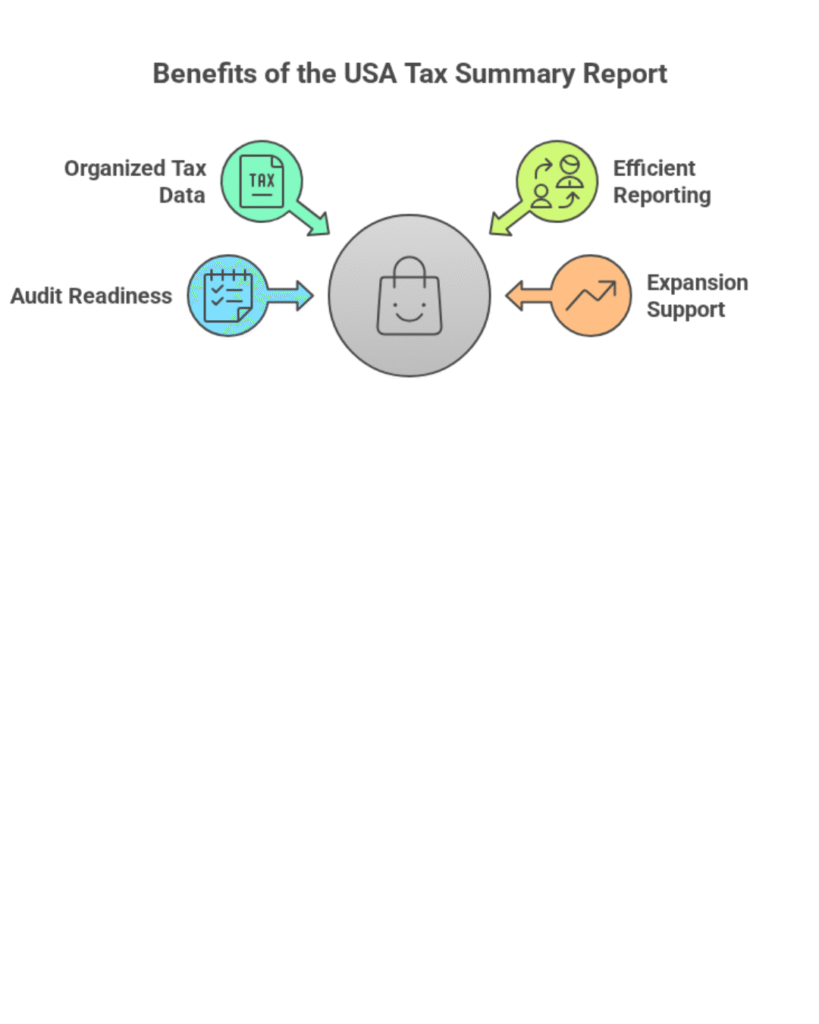

- USA Tax Summary (Shopify): If your Shopify store mainly sells in the U.S., the USA Tax Summary (Shopify) report is a necessity. It organizes every U.S. sales tax figure into a neat, centralized format.

Rather than manually drawing data from each tax season, you can export this report and simply hand it to your accountant. It is fast, dependable, and keeps your Shopify storefront stress-free in the event of audits or filings. This is particularly helpful if you intend to expand your store more in the U.S. market.

How ReportGuru Simplifies Tax Reports?

ReportGuru integrates perfectly with your Shopify store, auto-populating tax information from your sales and check-out processes. With your Shopify storefront connected, ReportGuru automatically produces each of the reports listed above without requiring any manual entry of data.

And if you ever find yourself confronted with questions or require assistance, ReportGuru’s customer support team are there to assist you. You won’t waste time digging through Shopify support articles trying to decipher tax regulations as the reports will take care of all that on behalf of you.

With the automated services, you can spend less time wading through spreadsheets and more time expanding your Shopify online store.

Conclusion

Handling taxes does not necessarily have to be a stressful or a complex process. With ReportGuru’s set of tax reports, ranging from Canadian Tax Breakdown Report to USA Tax Summary (Shopify) Report, you can take full control of your tax compliance while focusing on sales, marketing, and customer experience.

When your tax information is correct and easy to access, you have the confidence to grow your Shopify store worldwide. Whether you’re building your store from scratch or running a successful Shopify storefront, automated tax reporting sets you free to grow without penalty or mistake.

So, simplify your tax season once and for all, let ReportGuru make it seamless. Your Shopify site will appreciate it.